Islamabad approaches World Bank for $150 m credit

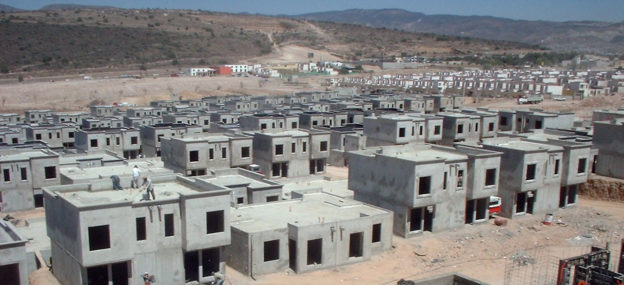

The federal government is planning to start a housing finance project for low-income Pakistanis with US$150 million credit from World Bank. The government has approached the bank for a soft loan of US$150 m for ‘Housing Finance Program’ which will help people get affordable financing for constructing their homes, officials said.

The loan will be provided in two tranches of US$145 m and US$5 m and will cost the cheapest interest rate. The bank will provide the loan at 1.25 percent interest rate. Pakistan’s central bank will provide it to the commercial banks which will utilize it for mortgage purposes.

At present, a federal program for housing is underway thus the government has to utilize it under that program as a foreign exchange component (FEC) or will make new PC-I for the purpose. It will require approvals from the CDWP and ECNEC.

Pakistan is facing a shortage of around 9 million housing units. An annual demand stands at 0.6 million units which is being added to burgeoning total. With a considerable future demand, Pakistan requires a huge investment in this sector. It requires to construct 0.5 million houses annually for 18 years. For such a purpose, a sum of US$2.5 billion is required to meet the fresh demand of 0.6 million units besides an amount of US$2 billion per year to address the backlog.